Flair Airlines says its cheap airfare and deals with regional airports are improving competition in the Canadian air industry, but as the Edmonton-based carrier seeks extra time to meet its licence requirements to keep flying, a rival airline is calling the company’s exclusive deals into question.

In looking at Flair’s deals at the Waterloo International Airport (YKF), where it has exclusivity on some routes, some experts are torn on whether such arrangements are unfair or can actually increase choice for travellers seeking more convenient and affordable flights.

Flair is currently the subject of a licence review from the Canadian Transportation Agency, which found in a preliminary review released in March that it might not meet the Canadian ownership standards to fly in the country. A formal decision will be delivered on June 1, the watchdog says.

The ultra-low-cost carrier has outlined steps it’s taken to fix the CTA’s concerns since the initial ruling but has also asked Canada’s transportation minister, Omar Alghabra, for an 18-month extension to meet the standards and refinance debt tied to an American investor.

Global News has reviewed a redacted version of that submission, in which Flair champions its role in adding competitive, lower-cost fares to the Canadian air industry as a primary reason it should be allowed to keep flying while it addresses the CTA’s issues.

But low-cost rival Swoop, owned by WestJet, has cried foul over Flair’s agreements at the Waterloo airport boxing it out of routes to the southwestern Ontario city.

The airline said in a statement to Global News that it reached out to the airport authority last month to add service connecting Waterloo to Edmonton and Halifax starting this summer, but was denied.

“Unfortunately, our proposal was denied as Flair Airlines has a monopoly through an exclusivity agreement with the Region of Kitchener-Waterloo and the airport authority,” said Swoop president Bob Cummings in a statement.

“These types of agreements are not common in Canada because they prevent choice and competition for travellers. It is never in the public interest to allow monopolies to develop and we are disappointed that travellers do not have the option to choose Swoop when planning their next trip to or from the Kitchener-Waterloo region.”

- N.S. mom calls for better ultrasound access after private clinic reveals twins

- As Canada’s tax deadline nears, what happens if you don’t file your return?

- 3 women diagnosed with HIV after ‘vampire facials’ at unlicensed U.S. spa

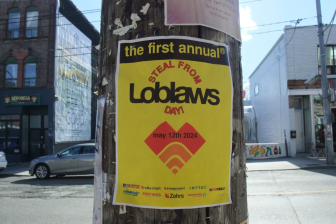

- Posters promoting ‘Steal From Loblaws Day’ are circulating. How did we get here?

Flair CEO Stephen Jones confirmed in a statement to Global News that the airline has exclusive rights to certain routes out of Waterloo and defended the arrangement as allowing it the freedom to build up service at the airport without the threat of other airlines crowding Flair out.

“Here’s the truth: every airline in Canada was offered a fantastic opportunity to fly from Waterloo on an exclusive basis, through a transparent RFP (request for proposals) process. Not a single one of our competitors bothered to respond,” Jones said in his statement.

“That’s how much they care about Waterloo. We do. Flair was the only one willing to take the risk and begin flying, and has developed a successful network and a great relationship with YKF.”

Exclusivity was Waterloo's idea

While Swoop’s criticisms about competition are levied largely at Flair, the Waterloo airport is the one behind the exclusivity arrangement, a program it launched roughly five years ago.

Airport director Chris Wood confirmed to Global News that Swoop’s request to add service to those routes was denied because they are locked up in exclusivity arrangements with Flair.

Wood also confirmed the airport has exclusivity deals with other airlines, though he did not provide specific names.

Wood says that when Waterloo introduced the program, it opened the gates to all airlines in Canada to make proposals for exclusive routes through the airport. Neither WestJet nor Swoop took Waterloo up on those offers, he says, though Swoop itself only began operations in the summer of 2018.

Cummings told Global News that the airlines “proudly declined to participate” in the program on “principle,” asserting that exclusivity is never right for consumers or the public interest.

“Having multiple carriers serving a market or route is how healthy competition works. It is in the best interest of the consumer to have multiple carriers, more choice, and lower fares. Flair and YKF’s multi-year exclusivity agreement confers an unfair advantage to one carrier to the detriment of consumers in the region,” he said in a statement.

But Wood says the program has “proven quite successful” since it began. Offering exclusivity gives airlines a chance to test out a route without the fear that a competitor will come in and undercut their prices, bullying them off the route, he says.

“This was something that was very attractive to certain carriers. Basically, it allows them to build a route without the threat of predatory behaviour that we have seen in this country before,” Wood says.

Flair, in particular, has been responsible for significant growth at the airport over the past few years.

Before Flair started flying from the airport, Waterloo saw roughly 100,000 passengers pass through in a year. It’s expecting 700,000 travellers in 2022 and hopes to hit one million next year.

“Most” of that traffic is coming through Flair, Wood says. The airport has plans to introduce another burgeoning carrier, Pivot Airlines, to its roster in the near future.

Is exclusivity anti-competitive?

Experts say measures that reduce competition on routes and artificially block other airlines from adding service are not illegal but can be unfair.

“Exclusivity, by its very nature, means keeping the competition out. So while (Flair is) talking about bringing lower fares to Canadians, especially to people of Waterloo … that’s anti-competitive, in my view,” says John Gradek, professor of aviation leadership at McGill University.

The only other example of exclusivity he knows of in Canada is Porter Airlines at Billy Bishop Airport in Toronto, but Gradek says the difference there is the airline owns the building itself.

Frederic Dimanche, director of the Ted Rogers School of Hospitality and Tourism Management, says he is torn on the concept.

He notes that it’s not unusual for regional airports to offer “special deals” or cheaper landing fees in order to attract low-cost carriers to their markets, but he has never heard of an exclusivity arrangement in Canada.

While he says the idea of exclusivity “goes against” the kind of competitive atmosphere Canadians and regulators would like to see in the airline industry, he notes that proving out new routes takes a considerable amount of time, research and risk.

Airports want airlines to succeed in building up their roster of destinations, and therefore it could be a “prudent approach” to allow exclusivity and let a route become established in the market before opening it up to competitors, he says.

“They don’t want any other airline to come in and cannibalize the potential success of a route,” he says.

In his statement, Jones accused Swoop of similar behaviour, alleging that many of the low-cost airline’s routes “mimic” those of Flair and suggesting they’d leave those markets if Flair were run out of town.

“This is exactly the kind of behaviour that YKF wanted to prevent by providing a time-limited exclusivity on specific markets. It allows an entrepreneurial carrier time to establish a market without WestJet or its puppet, Swoop, dumping capacity and copying the innovator, and then disappearing again when their dirty work is done,” he said.

Citing WestJet’s 15-year presence in Waterloo, Cummings shot back at the claims the airlines were not committed to the region and said Swoop had always planned to expand to the airport as part of its efforts to ramp up in the Ontario market post-pandemic.

“We are not the carriers at risk of leaving or being shut down,” he said.

Dimanche says that he would be surprised if any airport let that exclusivity reign for long once a route has proven successful. Letting airlines have a long-standing monopoly on a route often leads to higher prices than when they’re competing with another carrier for passengers, he notes.

Wood confirmed that the exclusivity deals it has with airlines are “time-limited” but did not say how long agreements tend to last.

From Waterloo’s perspective, letting Flair come in and run a route to Vancouver, for example, gives Ontario residents more choice when it comes to flying out west. Before Flair, Waterloo residents could fly to Calgary and transfer to get out west or drive to Toronto’s Pearson International Airport for the flight.

Now, they’ve got a bit more choice in how they make their trip, Wood argues.

“We’ve increased competition from what we had before because there was none,” he says. “Pearson is everybody’s local airport, and we’re trying to change that.”

Flair likely to fly over the summer, experts say

If the transport minister and CTA are interested in increasing competition in the Canadian airspace, they likely will keep Flair in the air for at least a while longer, experts say.

Gradek says that Alghabra likely won’t grant Flair the full 18 months it requested to find Canadian financing and meet the ownership requirements, but he could see the airline getting another three or four months.

“I don’t think there’s an imminent shutdown of Flair. They’re going to give them some time and probably allow Flair to go through the summer,” he says.

Dimanche agrees, and says the airline is likely to get a bit of “leeway” in the months ahead as it works towards fixing the ownership concerns.

“I think overall, it’s going to be good for the competitive environment in Canada, and that’s something that the federal agencies should be looking forward to,” he says.

Wood says Waterloo has been hurrying through a $35-million facelift for the airport including a new departures building to accommodate the anticipated volume from Flair.

Construction will fully wrap up just a day before Flair launches its expanded summer travel schedule out of the airport on June 7 — assuming its licence is in place.

Wood says he’s “very confident” that Flair has “addressed the concerns” raised by the CTA and that it will still be flying this summer.

But if Flair is grounded, he’s also convinced that the market to fly into and out of Waterloo “has now been proven.”

“We now have the facilities. We now have the room. So potentially, there are other carriers out there that could step in and provide some service” if Flair bows out, Wood says.

— with files from Global News’s Kevin Nielsen

Comments